Why Every Investor Ought To Be Active on a Forex Trading Forum for Success

Why Every Investor Ought To Be Active on a Forex Trading Forum for Success

Blog Article

The Importance of Currency Exchange in Global Trade and Business

Currency exchange acts as the backbone of worldwide trade and commerce, allowing smooth transactions in between diverse economic climates. Its impact expands beyond mere conversions, influencing rates techniques and revenue margins that are essential for organizations operating internationally. As changes in currency exchange rate can present substantial dangers, efficient money threat management ends up being vital for keeping an affordable edge. Comprehending these dynamics is crucial, particularly in an increasingly interconnected market where geopolitical uncertainties can additionally complicate the landscape. What are the implications of these aspects on market accessibility and lasting organization approaches?

Role of Currency Exchange

Currency exchange plays a crucial role in facilitating global profession by enabling purchases between celebrations operating in different money. As organizations significantly take part in worldwide markets, the demand for efficient currency exchange devices becomes extremely important. Exchange prices, which fluctuate based on numerous financial indicators, identify the worth of one money family member to another, influencing profession characteristics significantly.

In addition, money exchange minimizes dangers associated with foreign transactions by offering hedging choices that shield against negative money motions. This monetary device enables services to support their costs and profits, further advertising worldwide trade. In summary, the function of money exchange is central to the functioning of global commerce, supplying the necessary framework for cross-border purchases and sustaining financial growth worldwide.

Influence On Prices Strategies

The devices of currency exchange considerably influence pricing methods for organizations taken part in worldwide trade. forex trading forum. Fluctuations in currency exchange rate can result in variations in expenses linked with importing and exporting products, engaging business to adjust their rates models appropriately. When a domestic currency reinforces versus international currencies, imported products may come to be much less costly, permitting organizations to reduced costs or raise market competitiveness. Alternatively, a weakened domestic currency can blow up import costs, motivating firms to reassess their prices to preserve revenue margins.

Moreover, organizations need to think about the economic problems of their target audience. Local buying power, inflation rates, and money stability can determine exactly how items are valued abroad. Business usually adopt pricing methods such as localization, where prices are tailored to each market based on money variations and local economic variables. Additionally, dynamic prices designs might be employed to respond to real-time money movements, guaranteeing that organizations continue to be nimble and affordable.

Influence on Revenue Margins

If the value of that currency reduces relative to the company's home currency, the revenues recognized from sales can lessen significantly. Conversely, if the foreign currency appreciates, profit margins can enhance, enhancing the overall financial performance of the company.

Additionally, companies importing goods face similar risks. A decline in the worth of their home money can cause greater expenses for foreign goods, subsequently pressing earnings margins. This scenario requires efficient currency risk monitoring approaches, such as hedging, to minimize prospective losses.

Business visit the site must stay watchful in this contact form checking currency fads and changing their economic techniques appropriately to shield their bottom line. In recap, understanding and managing the impact of currency exchange on revenue margins is essential for services making every effort to preserve productivity in the complex landscape of worldwide profession.

Market Gain Access To and Competition

Navigating the complexities of worldwide profession requires services not just to manage revenue margins yet also to make sure reliable market access and improve competition. Money exchange plays a critical function in this context, as it straight affects a company's capability to go into brand-new markets and compete on an international scale.

A desirable exchange price can lower the expense of exporting products, making items extra attractive to foreign consumers. On the other hand, a negative price can blow up rates, hindering market penetration. Companies should tactically handle money variations to maximize rates strategies and stay affordable versus neighborhood and global gamers.

Moreover, organizations that efficiently use currency exchange can create opportunities for diversification in markets with positive problems. By developing a strong existence in multiple money, services can reduce threats linked with dependence on a solitary market. forex trading forum. This multi-currency approach not just enhances competition yet also promotes durability when faced with economic shifts

Dangers and Obstacles in Exchange

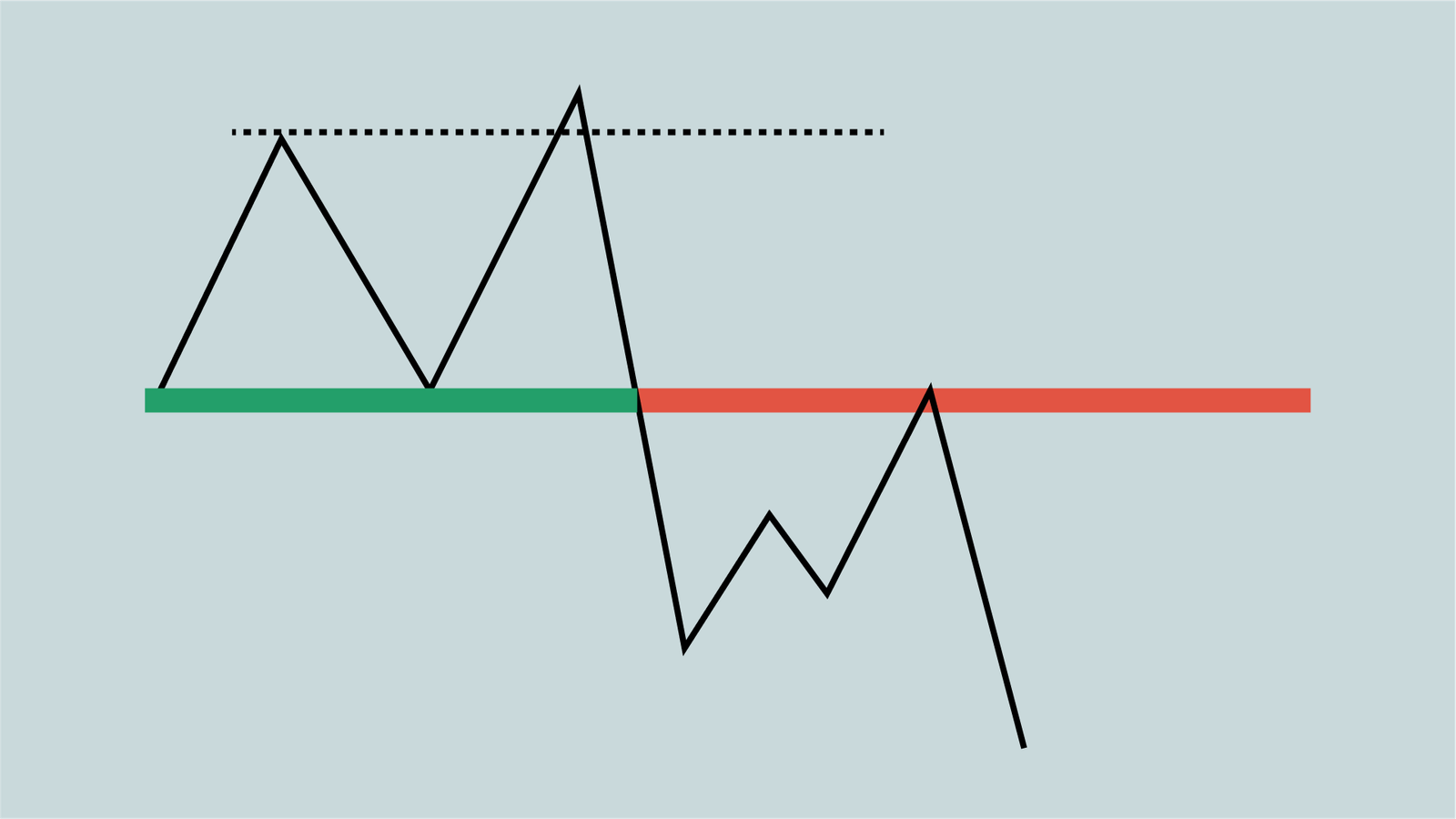

In the realm of worldwide profession, businesses face substantial dangers and difficulties connected with currency exchange that can influence their monetary stability and operational approaches. Among the main risks is currency exchange rate volatility, which can cause unforeseen losses when converting money. Changes in currency exchange rate can influence earnings additional resources margins, especially for companies participated in import and export activities.

Additionally, geopolitical aspects, such as political instability and regulative changes, can worsen currency threats. These aspects may bring about unexpected changes in currency worths, complicating economic forecasting and planning. Furthermore, organizations should browse the complexities of international exchange markets, which can be influenced by macroeconomic indications and market sentiment.

Final Thought

In final thought, money exchange serves as a cornerstone of worldwide trade and business, assisting in transactions and improving market liquidity. Despite intrinsic risks and obstacles associated with changing exchange rates, the value of money exchange in promoting financial growth and durability continues to be indisputable.

Report this page